Not only has the year seen Investible reaffirm our position as a truly global investment firm; the successes of our visionary founders and dedication of our global team have reflected Investible’s commitment to supporting the advancement of humanity through technology.

Here’s a snapshot of Investible’s year, by the numbers. Read on for the story of the year that was.

%20IMAGE%20BOLD%20NUMBERS%20%26%20COUNTRIES%20.png)

- 62 total investments

- 29 new portfolio companies

- 33 follow on investments

- 2 exits

- 12 countries represented in our portfolio

- 1 grand opening

- 1 new fund announced

- 8 new team members

One of APAC's most active VC's

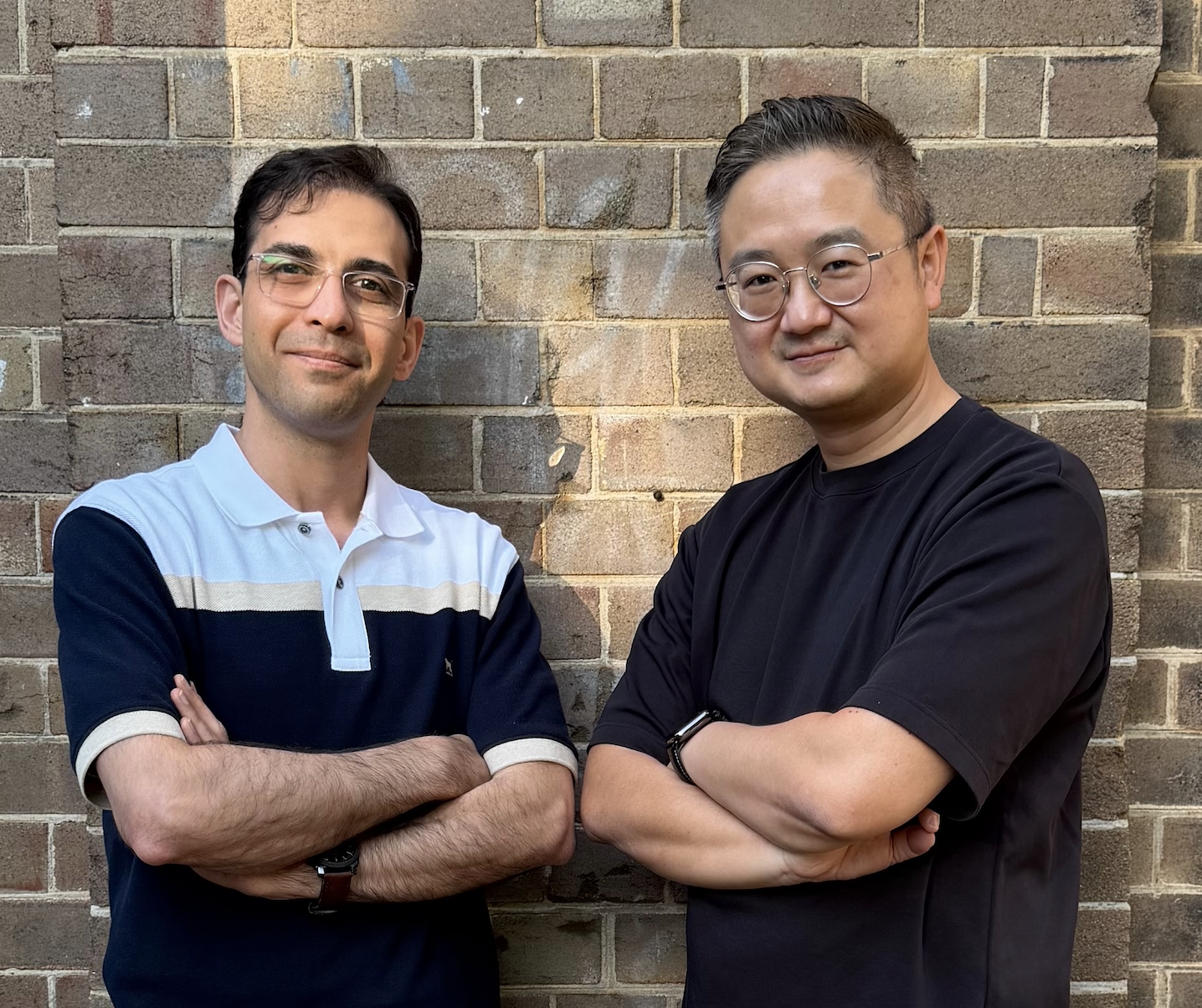

%20ALL%20FUNDS%20founder%20faces.png)

Despite a tough 2023 macroeconomic environment, our core investment activity remained strong. Our team deployed over $17m+ in capital across 12 countries, screened more than 4,200 potential opportunities, from which we made 29 new investments and 62 total investments across our two actively-deploying funds and Club Investible syndicate.

We’re built differently from most VC firms — we invest in groundbreaking tech companies via multiple investment vehicles, with all of our deal sourcing, screening and portfolio company investments managed by a globally-located team with wide-ranging experience and capability. A brief update from these investment vehicles below.

Early-Stage Funds

%20NEW%20INVESTMENTS%20FUND2.png)

Our multi-sector Investible Early Stage Fund 2 (2021) was among Australia’s most active VC Funds this year, backing 17 new early-stage companies across diverse sectors from fintech and insurance to logistics, edtech and AI.

In 2023, we celebrated two successful exits from our Early-Stage Funds, with the acquisition of MyRobin (by India’s BetterPlace) and LIGR (by Crionet). As our portfolios continue to mature, we anticipate to crystalise returns from several more investments from our vintage 2018 Investible Early-Stage Fund 1 and global HNW investor syndicate, Club Investible.

Climate Tech Fund(s)

Our commitment to the climate tech sector formally began with a 5% impact allocation in the Investible Early-Stage Fund 1; a 10% impact allocation in the Investible Early-Stage Fund 2; and the launch of the Investible Climate Tech Fund in 2021. Two years on, our strategy and conviction has accelerated and in 2023, we welcomed 12 new startups to the fund’s portfolio. These companies are solving key issues in the climate challenge from food waste, critical mineral recycling and solar deployment to the decarbonisation of concrete, aviation and more.

In October, Investible doubled down on our commitment to climate tech with the announcement of a new co-GP Climate Tech fund — a joint venture with Indonesia’s largest financial conglomerate, Bank Mandiri. With the launch of this fund, we are continuing our commitment to backing this vital sector, with a regional focus in Southeast Asia and Australia, as well as globally.

2023 also marked a key milestone for Investible with the launch of the Greenhouse Tech Hub (more on this below).

Club Investible

This year, the Club Investible syndicate welcomed more than 50 new members, were presented 19 new deals, made 26 follow-on investments and successfully invested $12.4m. The Club Investible calendar was full as we hosted events in Sydney, Singapore, Melbourne and Brisbane to build a stronger global early-stage investment community, leveraging Investible’s networks and investment process and methodology.

When our Club members and founders come together, the magic of the Investible model is most visible. Serendipity comes from fostering connection: the bread and butter of our day-to-day activity.

It takes a village

A core focus for us in 2023 was continuing to create and sustain relationships and partnerships, which play a pivotal role in our strategy. Our reach further extended into Indonesia, where we established the outline of the 'Mandiri-Investible Global Climate Tech Fund' with our new partners at Bank Mandiri and Mandiri Capital Indonesia.

%20IMAGE%20Rod%20and%20team%20with%20Mandiri%20%20.png)

The fund's investment strategy is rooted in the strengthened economic ties between Australia, Indonesia, Singapore, and the broader region—an illustration of the deepening connections seen in recent events like the ASEAN Summit (which will be in Melbourne in 2024) and Australia's Southeast Asia Economic Strategy to 2040.

Our community was more active than ever this year, hosting 12+ events across Sydney, Singapore, Melbourne and Brisbane. These events ranged from live pitches and fireside chats to engaging socials and dinners. Our team actively participated and supported creating connections across the Investible ecosystem.

Across Asia-Pacific and beyond, we fostered partnerships with entities at various stages of the innovation chain. A note of thanks to our collaborators including Enterprise Singapore, the UAE’s Hub71, Austrade, Investment NSW, Bluerock Advisors, SheLovesTech, MDEC, EMT Partners, Climate Zeitgeist, Block71, UNSW, SXSW Sydney, University of Sydney, KPMG, FD Global Connections, Fintech Australia, Tank Stream Labs, Climate Salad, Cicada Innovations, HaymarketHQ and so many more.

%20.png)

Of course, a further note our appreciation to the countless funds and investors whom with we co-invested into a new generation of technology companies.

The Investible Portfolio

2023 was a dynamic blend of capital deployment and portfolio growth. We bolstered our support by providing follow-on investment to 33 of our portfolio companies through our Funds and Club Investible; enabling them to continue to scale and grow.

A few of these successful raises included: Applied EV’s strategic investment from Suzuki, Quantum Brilliance’s $26m round, Fingerprint for Success’ $6.5m Seed, Nexl’s $6.6m Series A, Jigspace’s $5.2m round, and Sicona Battery Technologies’ $22m Series A.

In addition to the afore-mentioned 2 successful exits (LIGR, MyRobin), we have seen some notable milestones achieved within our portfolio:

TeOra won a S$1.1m grant, with top prize in the Temasek Liveability Challenge 2023 for their contribution to disease management in aquaculture, and Xylo Systems took home $100k prize in the 2023 KPMG Nature Positive Challenge. Quantum Brilliance secured a $1.4m grant from the NSW government.

Our Team

%20Team%20(IT%20TAKES%20A%20VILLAGE.png)

As we reflect on our accomplishments, it's crucial to recognise the diligent efforts of our team: without whom none of this will have taken place. Our team serves as the bedrock of our success, embodying our values and laying the groundwork for future growth while breathing life into our business.

This year, we celebrated the well-deserved promotions of two exceptional members of team Investible: Jayden Basha as Investment Principal and Ben Lindsay as Investment Manager. This affirmation holds true for our firm as much as it does for the startups we support—capable, ambitious individuals are the driving force behind any business's progress.

We also looked outward to bring in new expertise into the Investible crew across our governance, leadership, investment and operations teams. We brought aboard Charlie, Nicholas, Caitlin, Wolmorry, Kelley, as well as Christine Amour-Levar and Dr. Bill Foo to our Singapore Funds board, and Dr. Darian McBain to our Climate Tech Investment Committee.

In December, we appointed two new Venture Partners to our team, Rob Hulme in Australia and Tina Di Cicco in the Philippines. Venture Partners are a key part of the Investible model, supplementing Club Investible with specific expertise to help raise capital and identify, evaluate, co-invest and support Investible group portfolio companies.

The Investible Women’s Network

It’s no secret that the tech and VC landscape is male dominated, in Australia, Asia and globally. While Investible has made some impact with 43% of our Climate Tech investments having a female founder, we have made the decision to take decisive action to support growth of female participation in tech.

This year, Investible is proud to have launched the Investible Women’s Network — a collective of founders, investors and advisors from within the Investible community. The network will expand its impact in 2024 with events, workshops and opportunities for women and non-binary members in our network to find mutual support, growth and fulfilment through community.

Introducing: Greenhouse

This year, more than 4 years of ideation and hard work saw the Greenhouse Tech Hub come to fruition in Sydney. A new project that is part of the overall Investible group but with its own unique brand identity and positioning, Greenhouse is a climate action ecosystem connecting key stakeholders who are dedicated to helping solve our world’s most pressing challenge: climate change.

In the latter half of 2023, the Greenhouse team, led by Investible co-founder Creel Price achieved several milestones:

- Opened the Greenhouse Tech Hub: A joint effort from the City of Sydney and Investible saw the official ribbon cutting of the Hub, an ecosystem and shared office space dedicated to climate action and co-innovation.

- Hosted two Greenhouse Challenges: Greenhouse organised the ANZ Climate Tech 100 via a collaborative project, and the World Economic Forum’s First Movers Coalition Near-Zero Steel 2030 challenge (ongoing).

- Assembled a stellar and passionate team of climatarians to help Greenhouse scale in Sydney and globally.

The journey for Greenhouse is only just starting. Expect more events, co-innovation opportunities, and challenges in 2024. Follow the project on LinkedIn or via their newsletter to keep in touch.

To say it’s been a busy year would be an understatement. As we enter a brief but well-deserved period of rest, reflection and recharge, we look forward to what is sure to be an awesome, challenging and rewarding 2024.

Take care and we’ll see you there!

Team Investible