Investible’s 12 Favourite Moments of 2019

December 12, 2019

It’s time to soon say goodbye to 2019. But before we welcome in a brand-new decade, we wanted to take a few moments to reflect on what we’ve accomplished in the last 365 days (especially considering that 1 ‘Investible Day' is equivalent to a few normal ones!) and what we hope to achieve in the next.

We asked each of our team members to share their most Investible moments from 2019.

Here’s what they had to say…

12. “One of the big highlights this year was successfully closing the Investible Early Stage Fund above target and making investments in 11 incredibly strong businesses and founder teams.” - Daniel Veytsblit, Investment Director

“Closing our first venture capital fund with more than $22 million in committed capital was a significant step forward for the business. This year, we screened 1,500 potential investment opportunities globally and made 11 investments, with many others approved by our Investment Committee still to be finalised. The portfolio is also showing early promising signs, with our first investment already completing a subsequent raise at a valuation five times the initial raise.”

“We see Investible as filling a significant gap in the market for quality, early-stage funding and I’m looking forward to what is set to be another big year working with the best founders and startups across Australia and South East Asia.”

11. “This year, the Investible Games was my highlight. We travelled more than 25,000 km to deliver five successful events across Australia, Singapore and Jakarta and worked closely with 108 early-stage founders in the process.” - Hayley Tulich, Program Coordinator

“The Investible Games is such a unique experience for founders who are preparing to raise capital but it also gives us the opportunity to get to know founders across South East Asia. The intense, two-day format also leads to valuable connections, shared knowledge and lots of cross-border friendships.”

“We have sought feedback, iterated and improved with each games and we now have a program that is truly a ‘win-win’ for founders, partners and investors.”

10. “This year, we welcomed our 60Club Investible member. With members located across Australia, New Zealand, Singapore, Thailand and beyond, Club Investible helps us better source quality investment opportunities and better support our portfolio founders.” - Hugh Bickerstaff, Chief Investment Officer

“Club Investible is our invitation-only network of active, sophisticated angel investors, which runs in parallel to our Funds. Members have access to curated investment opportunities and information packs prepared by our analysts to inform their decisions and are given the opportunity to co-invest if they want deeper exposure to certain businesses.”

“Combined with our pre-investment programs, Club Investible help us mitigate many of the sourcing and scalability challenges that come with early-stage investing and support our growing portfolio with connections and expertise.”

9. "I have loved every single minutes of working with the retail and hospitality owners who participated in Australia’s first Retail Innovation Program this year, which we are thrilled to be delivering for a second time with the City of Sydney. We continue to support the entrepreneurs from the first cohort and I’m constantly in awe of their passion, talent and commitment to their business and helping one another succeed.” - Elisa-Marie Dumas, Head of Programs & Partnerships

“To me, the Retail Innovation Program demonstrates the power of collaboration and partnerships. Many of those founders will participate as mentors in the second program, which we will officially kick-off in February 2020, and the new businesses will have the support of more than 15 partners including Amazon Launchpad, Google, Afterpay, EY, Digivizer and Fishburners. I am grateful for any opportunity that provides me with the ability to tap into under-leveraged talent pools and support them through their next stage of growth.”

8. “We hosted our first AngelBid event in Singapore this year, reflecting the strong relationships we’ve built there and the growth of Club Investible locally.” – Jake Booker, Investment Analyst

“For us, the event was the culmination of years of hard work refining our investment process and building trust and awareness within the Singapore ecosystem and South East Asia more broadly. We had four great companies presenting to a packed room of investors and our Club Investible Singapore members. Even better, all four of those companies received investment from either Investible and/or Club Investible.”

7. “This year, we collaborated with UTS's Masters of Data Science program to undertake a variety of projects to examine our investment data as part of our strategy to use machines and modelling to understand and predict investment success.” – Jackson Edmonds, Head of Data & Technology

“Having collected enough data to begin proper analysis and modelling, this was an exciting first step for the business. We were overwhelmed by the positive results. While there is still significant exploration and development that needs to be undertaken, seeing the initial outputs from these projects really gives the sense we're on the right path to further validating and refining our approach.”

6. “Another highlight was gifting our founder and startup accelerator program to two Indigenous-focused business development providers, Indigispace and The Cultural Intelligence Project, who will continue to deliver the programs to Indigenous founders around the country.” – Elisa-Marie Dumas, Head of Programs & Partnerships

“We’ve learned so much from our previous Indigenous accelerators and we felt strongly that we could best benefit Indigenous founders across Australia by empowering proven Indigenous entrepreneurs to take the lead. It’s amazing to see entrepreneurs who participated in those initial programs go on to make such a positive impact in Indigenous communities.”

5. “For me, my highlight was joining the Investible team full-time. I get to work with a business that adds consistent and meaningful value to the Australian and South East Asian startup ecosystems and a team that is passionate and committed to making a positive impact.” – Lauren Trucksess, Marketing Manager

“Investible has been producing incredible IP and programs and making solid investments for years, so I’ve enjoyed uncovering and sharing the unique stories and insights from the team, our portfolio founders and network. I’m always on the lookout for the next big think and there’s a significant story to tell around the potential opportunity in early-stage investing, especially when backed by real data and relationships.”

4. “This year, we expanded our Recruitment service to make it easier and more cost-effective for founders to fill key openings and instead, enable them to focus on the day-to-day running of their business.” - Celeste Kocabay, Head of Talent

“Internally, we focused on finding new ways to improve our team culture, rolling out our monthly ‘Kudos’ program, adding fun, team-building games to our monthly lunch initiative and embraced the power of mindfulness this year, starting all of our weekly team catch-ups with five minutes of guided mediation.”

3. “There are lots of highlights as Investible hosted and/or participated in more than 60 events across Australia and South East Asia this year, but one of my favourites was serving as a mentor to 10 to 16 year old entrepreneurs as part of the Young Founder School programs.” - Annie Luu, General Manager, Asia

"While it’s always rewarding to help our portfolio companies launch their products and services into Asia and expand their global network through Club Investible and our partners, I felt honoured to support the future generation of leaders explore their talents and potential.”

2. “Looking back on this year, I enjoyed those many small moments of partnership and friendship that lead to deeper relationships and more powerful collaborations.” - Trevor Folsom, Chairman and Cofounder.

“Investible has always been a collaborative business, as we know the power that networks bring to our investors and founders. But this year, we saw Club members and co-investment partners come together in new ways to collaborate on deal opportunities. We also gained a strong partner in Singapore in Vulpes Investment Management that will set us up for even greater success in 2020.”

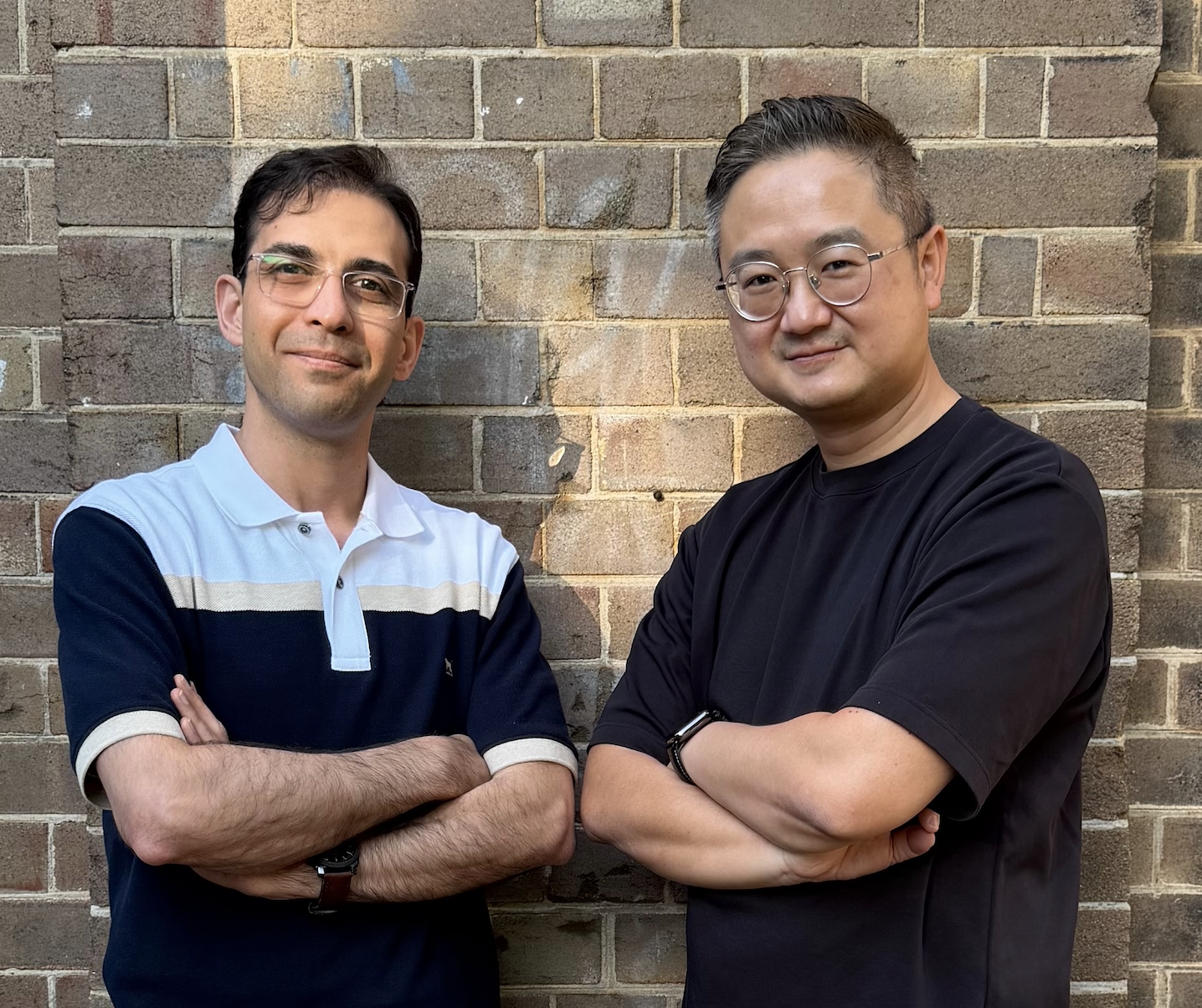

1. “We grew our team significantly in 2019, welcoming new faces to our Investment, Programs and Operations teams, at all levels of the business across both Australia and Singapore. We can ensure we can deliver on our mission to become the region’s most active early-stage investor.” - Creel Price, CEO and Cofounder

“Our team culture is a critical component of our success. You can achieve so much more when your team is aligned on the vision but also brings their own unique perspective and skills to the table. I feel confident that we’re heading into 2020 with a strong commitment to building the region’s best network of active angel investors and supporting its best founders in achieving their goals.”

Thank you to all of our partners, portfolio companies, investors, Club Investible members, Investible Games alumni, program alumni, and other founders and supporters! You’ve all played a role in what has been our biggest year yet and we look forward to working with all of you in 2020 as we continue to identify, support, invest in and grow the world’s best early-stage founders and startups.