Investible's Climate Tech Fund led Renewable Metal's $8 million Seed round with participation from investors including members of the Club Investible syndicate, Clean Energy Finance Corporation (Virescent Ventures) and Grantham Foundation for Protection of the Environment. In these investment notes, we will share insights into our rationale for investing in the Renewable Metal’s technology and team!

Lithium-ion batteries were traditionally used in electronics, telecommunications and other applications, but thanks to a small car manufacturer headquartered in Austin, Texas, and other innovations across transport and energy storage, the demand for lithium-ion batteries has sky-rocketed. And according to the US Department of Energy, we can still expect a 10-fold increase in demand over the next decade.

Despite this, the world's current mining operations cannot extract enough lithium and other vital minerals to meet the growing demand for lithium-ion batteries. Additionally, for various reasons, only 5% or fewer of used lithium-ion batteries are recycled today, meaning most end up in landfills [Source]. The battery industry must move from a linear to a circular value chain where used materials are repaired, reused, or recycled [Source].

So why has battery recycling not taken off? Current recycling business models are costly and heavily dependent on various factors, including battery design, process quality, and shifts in market supply or raw-material demand. There is excessive use of acids and other chemicals that produce nasty by-products, and the yield of reusable materials is often low.

Meet Renewable Metals, an Australian-based company that has developed a game-changing, battery recycling technology that achieves:

- High recovery – lithium extraction greater than 95%

- Low capital and operating costs – roughly 30% lower costs than competing processes due to the recycling of chemicals and far fewer processing steps

- Less impactful – operates at a low temperature (resulting in less energy usage), without creating a secondary waste problem (disposal of byproducts like sodium sulfate)

- Can recycle all major lithium-ion battery chemistries

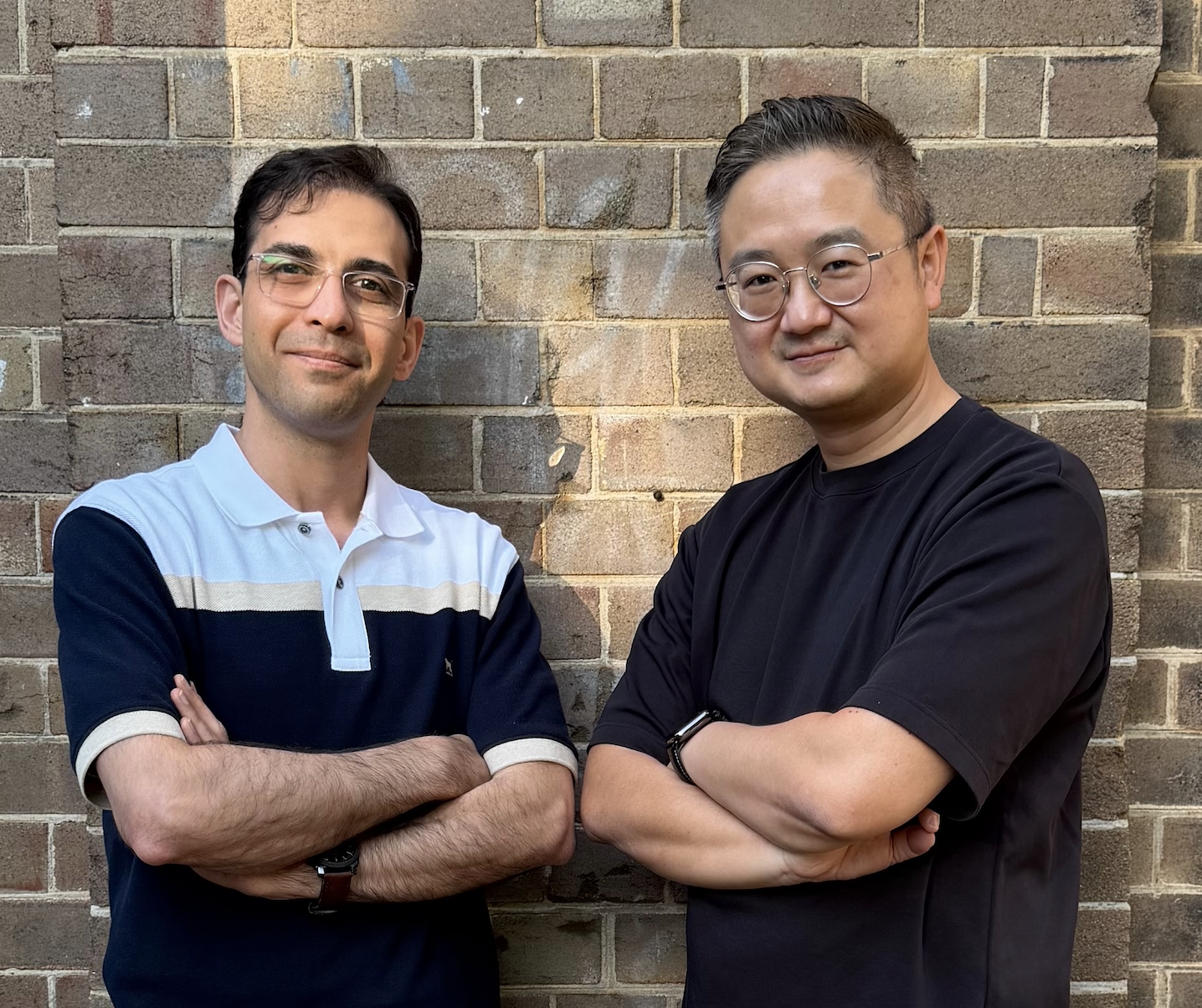

Renewable Metals is led by CEO Luan Atkinson and CTO Mark Urbani, working with a team of experienced metallurgists with prior experience in taking a concept to an industrial sized plant.

Multiple Battery Chemistries with Strong Economics

Most battery recyclers do not recycle lower-value-containing metal batteries such as lithium-ferro (iron) -phosphate (LFP) batteries as they cannot do so economically. While nickel manganese cobalt (NMC) remained the dominant lithium battery chemistry with a market share of 60%, LFP is following behind with a share of just under 30%, the highest market share in the past decade due, mainly in part, by the preference of the Chinese OEMs.

Renewable Metals have demonstrated their ability to recycle all these battery chemistries, with strong economic upside and dramatically reduced impact. This is due to fewer processing steps (no need for the batteries to be pre-processed into black mass and a single solvent extraction stage); the use of an alkaline leach which can be recycled with no chemically precipitated byproducts, making metal recovery easier and cheaper; and lower CAPEX and OPEX requirements.

Aussie, Aussie, Aussie

As the demand for energy storage and batteries grows, so does the waste. And, here in Australia, less than 10% of our lithium-ion battery waste is recycled (compared to 99% of lead-acid battery waste). This is despite the reusability of 95% of lithium-ion battery components. So, how do we currently deal with it? We send it overseas...

In failing to recycle these batteries, Australia is dumping potential critical metals resources and polluting the environment and reducing our sovereign capability to provide the necessary inputs for batteries. This adds to the current landscape of lithium-ion battery production, where Australia mines about 53 per cent of the world’s lithium supply, and virtually all of it is sold to China.

Renewable Metals, as well as a game-changing technology, are poised to play a crucial role in advancing Australia’s sovereign capability in the battery supply chain. We are thrilled to join them on this journey from the earliest stages.

A resilient pre-seed investor turned CEO

Talking about the team's strengths is a common point in all my (and other Investible team members') investment notes. We shamelessly prioritise the founding team because having the right founder(s) is the most impactful factor in startup success. We discuss this more in our blog on the Investibility Index, our framework designed to help us effectively evaluate investment opportunities by focusing on the factors that matter most to a startup's long-term success.

In the case of Renewable Metals, we saw a remarkable founding team with a strong technology background (founder Mark Urbani is the CTO) and a competent CEO in Luan Atkinson. Luan moved into the CEO role after initially investing in the Renewable Metals pre-seed round. Former lawyer, management consultant and finance executive, Luan consistently impressed the investment team during due diligence. After putting Luan and Mark in front of a handful of contacts in the space, we only continued to hear great things.

After visiting Perth to see the demonstration plant in action, we were blown away by Mark’s tenacity. With a brief window to show the demonstration plant to customers, Mark seldom left the site; something you might see in the biography of everyone’s favourite EV, spaceship and social media owner. With Mark and Luan at the helm, we are confident in Renewable Metal’s ability to overcome the incoming obstacles.

The Investible Climate Tech Fund is delighted to lead the investment into this brilliant team and is looking forward to supporting the Renewable Metal's team on their journey to be the leading lithium battery recycling technology globally.