This serial entrepreneur has advice for fellow non-technical founders

By

Franko Ali

May 9, 2021

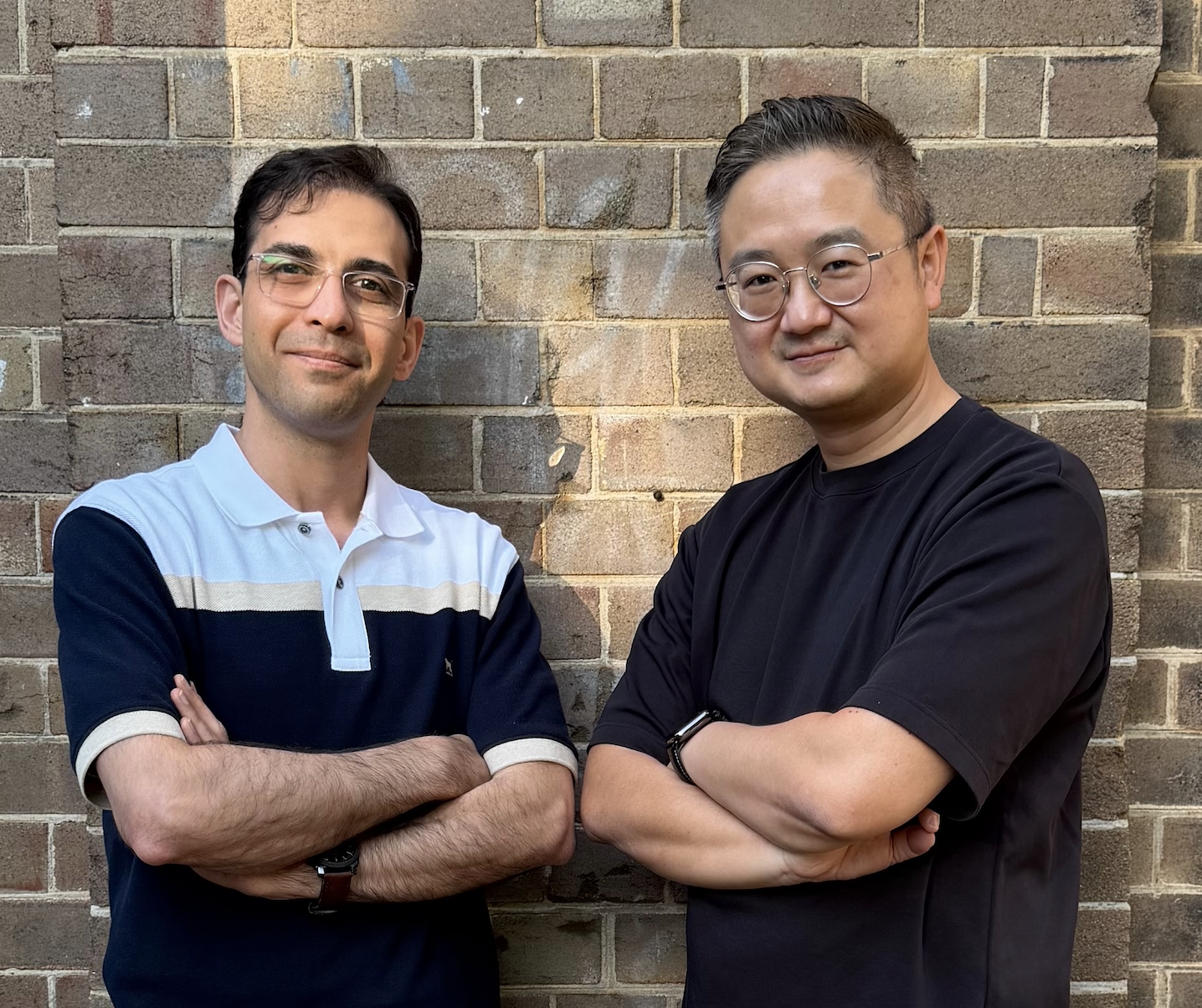

Effi CEO and co-founder Mandeep Sodhi reflects on some hard-earned lessons from his journey as an entrepreneur.

Rarely are successful, long-running businesses founded by first-time entrepreneurs. The founder’s journey instils impactful experiences that are hard to get from a book. In fact, we look out for these war-stories whenever we meet founders.

Mandeep Sodhi is one of these storied serial entrepreneurs. Effi, the AI-powered mortgage broker management platform is his fourth venture. He’s seen his fair share of start-ups and downs, and it’s clear how much he’s learned on his journey.

Fresh off a $1.2 million seed raise this year, Mandeep and his growing team have lofty ambitions for streamlining the mortgage broking industry. By utilising artificial intelligence and real-time data, Effi empowers mortgage brokers to nurture and streamline their relationships with clients. It’s a product with users at its heart.

We sat down with Mandeep to hear some of his most cherished lessons. Plus, some nuggets of wisdom for founders—especially those who are going it alone.

Let’s start with some backstory. What did you learn from your earlier businesses?

Effi is the fourth business I’ve built, and each of them have taught me valuable lessons. Over a decade ago, I bootstrapped an online liquor delivery startup. When the global financial crisis hit, I jumped at the first buyout offer. The mistake was to sell out too quick and too cheap. You don’t forget things like that.

My second venture was a product that helped retailers promote last-hour promotions to people nearby. Unfortunately, location-based services back in 2011 simply weren’t that good yet.

This experience taught me that you need a good technical co-founder from day one. Even if you’re a solopreneur, get someone who knows the tech in your corner. Otherwise you just start pumping money into tech. It can be endless.

That said, having a non technical background actually helps a lot. You first need to be clear on the outcomes you want to achieve, and then bring tech into the picture.

Effi isn't the first tech company you’ve built in the mortgage space. How has your perspective on the sector evolved?

My previous business, Hashching, helped customers compare pre-negotiated mortgages from top local mortgage brokers in a marketplace-like model. 86% of people in Australia start their mortgage journey with a comparison site. When there’s already that level of trust, why compete? Mortgage brokers have good CRMs available, but they don’t have a lot of support for documentation and lead management. Even though we were generating leads with Hashching, we saw a lot of blind spots. It was so manual, broken. There was a huge chance to automate.Effi allows brokers to build on top of our system with a fully white labeled version of our product. Once a lead fills out a form, Effi streamlines the whole process. All the while, it’s fully transparent for the customer. We also help mortgage brokers grow their business and brand by showcasing their profile on high traffic home loan websites where borrowers can select a broker they want to proceed with.

What advice do you have for early-stage founders?

First, make sure you hire the right team from day one. We were building a tech enabled solution so I needed the right team with the right technical skills.

Second, be careful on who you take money from. Do due diligence on your investors. When we started raising this most recent round, we were very open and honest on what we expected from our investors. We wanted strategic money coming in. We want investors who are there when times are good, and bad.

Lastly, do not run out of cash. Make sure the burn is under control, and trust your gut feel on when to hit the gas and brake with your finances.

How has speaking with your customers informed your product development?

Sell a great product but don’t sell a perfect product. Founders should know a ‘perfect product’ doesn’t exist. There will always be another CRM that has something we don’t.

“Why don’t you build XYZ?” can be a blessing and a curse. Stick to your core product first. Don’t start too many new things. You’re not there to satisfy every user out there.

We strive for a balance of 50% feedback and 50% product vision. We’re always focused on our core offering.

What’s next on the roadmap for Effi?

Right now it’s all about finding product market fit— finding the right customers. We’re staying focused on making sure the value proposition is super clear.

Our customer focus has also unlocked some exciting opportunities with product features like language translation. Brokers can have conversations with their borrowers in a different language but Effi translates to English for compliance records.

Anything we can do to help streamline compliance processes is a huge win for us and our customers.

What advice do you have for fellow solo founders?

Surround yourself with really good mentors early on.

At times, you have to exude a strong personality when you lead a team. It can take a lot out of you, and on the other end, you need someone you can talk to openly. Someone on your side. I have a mentor who calls me at 6pm on weekdays and asks how is your day? It makes a huge difference.

An advisory board really helps. A group of people who can protect you, help you, and help your business grow.

I serve this role for a couple businesses as well. It’s refreshing for me as a founder because I can step out of my day to day thinking. I get to look at strategy from another angle.

Our thanks to Mandeep for sharing his insight. Find more about Effi here.