Imagine a startup that’s got a compelling idea, a competitive business model with a lucrative market opportunity, and some solid early traction. Sounds like a no-brainer for investment, right? The reality, however, is that investors turn down these types of companies all the time.

That’s because the factor that best signals the startup’s chance of success isn’t their product, traction or sector. It’s all about the founder.

To a seed stage investor, founders are the X-factor. In fact, at Investible, we over-index on understanding and assessing founders and founder teams when making investment decisions.

There are a number of reasons for this. First, the founder IS the startup, particularly at the early stage. Business models can change, but founders’ attitudes, motivations and characters usually do not. The second reason is a matter of practicality; early-stage investors simply don’t have the same level of information on early-stage companies as they would for a listed or later stage company – because the information doesn’t yet exist. We need to rely on the founder to put in the work to make it happen.

So, what qualities do we look for? These are my top two.

1. Passionate connection to the problem

Every great venture solves a real problem. What constitutes a ‘real’ problem is up for debate, but at its simplest, it’s an issue that customers would pay to fix. Founders not only need to be attuned to this problem but also have a real passion for solving it. The best founders have lived and breathed the problem and have a relentless desire to solve it.

Why is this so important? A passionate connection to the problem strengthens founders’ ability to ride the highs and grind through the inevitable lows. This passion is the source of critical qualities including initiation, resilience and perseverance.

To get to the heart of the founder’s passion, we attempt to understand the “why”. Why have you started this venture? Why are you the founder to solve this problem right now? If you’re thinking about starting a new venture, these are two questions are the best place to begin.

Founders who don’t have a passionate connection to the problem are usually those who see an opportunity to make a quick profit. Money may be a big motivator for founders but it shouldn’t be the only one. If it is, founders who come upon hard times are likely to jump ship to another problem, where there is a perceived quicker and easier route to profits.

2. Coachability

Early-stage businesses will face a lot of different challenges. While no pathway is the same, there are common strategies to scaling that may ease the volatility of start-up life. As a founder, who you surround yourself with is important. But I’m not just talking about the faces in your pitch deck. I mean having people who provide you with active feedback and insights.Undoubtedly, founders need to be confident and headstrong – to trust their instincts and block out the naysayers. But having a trusted group of advisors and supporters is critical to venture success. Ideally, your advisors and supporters should have diverse perspectives to be able to advise on different aspects of scaling and should have scaled a business themselves previously or been part of a high growth venture. They should be able to identify problems before they occur and provide active guidance and assist founders reactively as well.Most importantly, founders need to actively listen to and learn from their advisors and mentors so that they can learn from others’ mistakes and experiences and capitalise on new opportunities.

How we assess founders at Investible

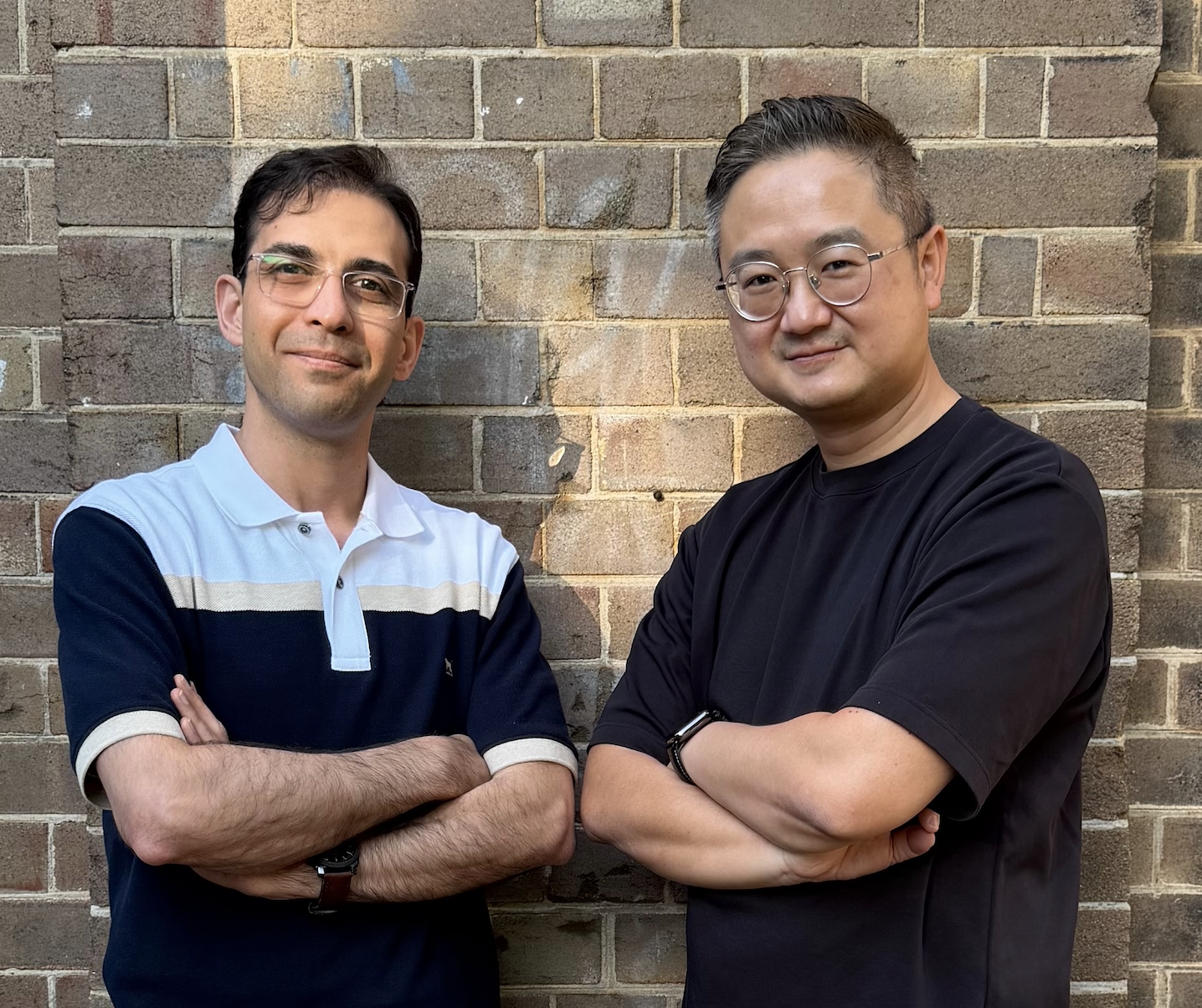

From pitch materials to programs and coffee meetings through the full due diligence process, there are a number of ways we can get to know founders before we invest. One tool that enhances our qualitative assessments is Fingerprint for Success (F4S).

F4S is a tool that measures founders’ attitudes and motivations and benchmarks these against a general population as well as sample of founders who have started, scaled and exited ventures. It gives us a consistent framework to assess founders and informs our views around founding teams, their affinities, contrasts and potential blind spots.

When preparing to raise capital, it may be tempting to focus on your product or gaining traction and hitting critical milestones. But I encourage founders to remember that we’ve investing in you – not just your business. Help us understand what makes you tick, how you make tough decisions and how you learn and give us the confidence that you’re the right person, with the right idea, at the right time.

Enjoyed this piece? Reach out with any burning questions or topics that you’d like me to explore.